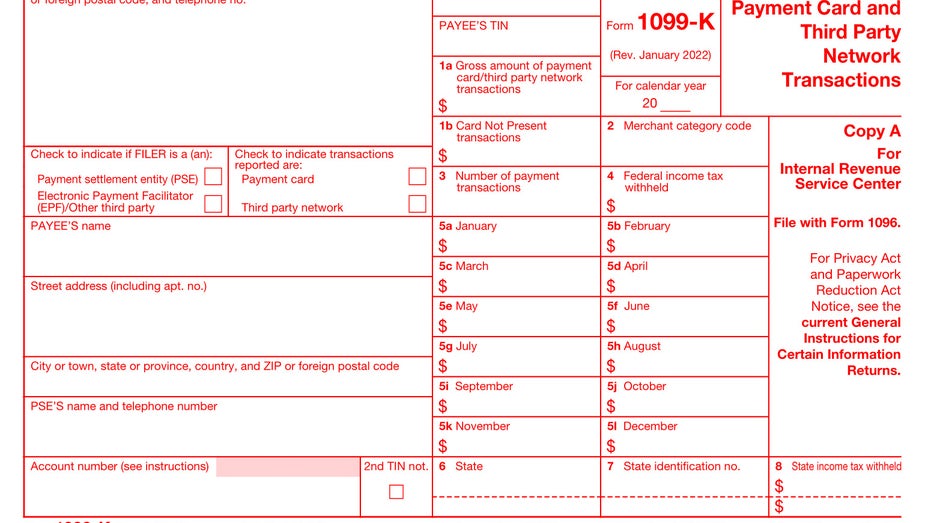

The Internal Revenue Service (IRS) released an updated version of the Form 1099-K FAQ for taxpayers and tax professionals this week. party organization.

Aside from answering frequently asked questions from taxpayers about Form 1099-K, the updated IRS document includes the agency’s recent announcement that calendar year 2022 will be considered the transition year for new rules lowering the reporting threshold to $600. is emphasized.

The changes, enacted under the Democratic American Relief Plan Act, threaten to affect millions of Americans who use third-party apps such as PayPal and its subsidiary Venmo to send or receive money. but will not apply next tax season. .

You should not receive a 2022 1099-K unless your total payments exceed $20,000 and your transactions exceed 200. However, due to the late December implementation announcement, some taxpayers may inadvertently receive Form 1099-Ks with a lower threshold early next year despite the change.

IRS postpones new tax reporting rules for VENMO, PAYPAL payments over $600

The IRS’s updated FAQs help taxpayers understand why they receive a Form 1099-K and what types of income and transactions they must report on the form. Here are some of the key points:

Are gains and losses from the sale of personal items required to be reported on Form 1099-K?

Profits from the sale of personal effects are considered taxable income and must be reported to the IRS on Form 1040 Schedule D. This is the capital gains and losses section of your personal income tax return. Form 8949 to report sales and disposals of fixed assets.

Proceeds from the sale may also be reported on Form 1099-K. The IRS FAQ used the example of a taxpayer where he received $900 for a $500 ticket. 1099-K displays $900. It is up to the payee to show a profit of $400 on Schedule D and Form 8949. Without proper reporting, the IRS may consider the full amount taxable.

Losses from the sale of personal items are not tax deductible. Also, if the taxpayer received a 1099-K for a sale that resulted in a net loss, an offsetting entry must be made to report the cost of the item. Income received on Schedule 1 of Form 1040. He can only report expenses up to his earnings amount, so if he buys an item for $1,000 and sells it at a loss of $600, he lists $600 as the selling price. Complete a portion of Schedule 1, complete “Form 1099-K Selling personal property for loss….$600” and zero out another line of Schedule 1 entries.

5 things to know about taxes in 2023

Reflections of pedestrians are seen past the Internal Revenue Service (IRS) office building in the East Harlem neighborhood of New York, USA, Saturday, June 24, 2017. (Photo by Timothy Fadek/Bloomberg via Getty Images / Getty Images)

Can I receive a Form 1099-K if I have a holiday craft business?

According to the IRS, those who run a holiday craft business may receive a Form 1099-K based on the type of transaction.

If you accept payment cards such as credit or debit cards, you will receive a Form 1099-K showing the total amount of payments made to your payment card during the calendar year. This reporting requirement has not changed and there is no minimum threshold for such payments to trigger the reporting requirement.

You may also receive a Form 1099-K if you receive payments from a third-party payment institution, have more than 200 transactions, and receive more than $20,000 in total payments in a calendar year.

Will using my credit card for small business or non-profit hobby purchases trigger a 1099-K report?

According to the IRS, if you are a small business owner or non-profit hobbyist who cannot use credit cards but use credit cards and third-party payment organizations to purchase goods, materials, or supplies, , should not receive a Form 1099-K. their purchase.

Financial New Year’s Resolutions for 2023

A man enters the building of the Internal Revenue Service (IRS) in Washington, DC, USA, Friday, May 7, 2010. (Photo by Andrew Harrer/Bloomberg via Getty Images / Getty Images)

Who is responsible for reporting transactions?

For payment card transactions, merchants sending funds to participating payees are responsible for reporting the total amount of the Reportable Transaction.This can be outsourced to processors who may share contractual obligations

With respect to Third Party Payment Transactions, the Third Party Organization or its electronic payment facilitator is responsible for reporting the total amount of Reportable Transactions paid to Participating Payees within its network.

Who should taxpayers contact if they have questions about Form 1099-K?

The IRS says taxpayers should contact the filer if they have questions about the information on the Form 1099-K they received. Filer contact information is located in the top left corner of the form.

If the taxpayer does not recognize the filer, they should contact the payment clearing house whose name and phone number are listed above the account number in the lower left corner of the form.

What Happens When the Lower Threshold $600 Threshold is Enabled?

As previously mentioned, the threshold for third-party transactions will not be lowered to $600 in calendar year 2022, but is expected to take effect in calendar year 2023. That means taxpayers will have to deal with it when filing their returns. Unless the IRS issues another delay or Congress moves to change the threshold, 2023 will revert to 2024.

Once the implementation delays are cleared and the new rules take effect, the reporting threshold will be lowered from gross payouts over $20,000 on over 200 transactions to a threshold of $600.

CLICK HERE TO GET FOX BUSINESS ON THE GO

Senator Mike Brown (R-Ind.) provides details about the IRS starting to submit 1099-K forms for some payments on “Fox Business Tonight.”