ROE or Return on Equity is a useful tool for evaluating how effectively a company is able to generate returns on the investment it receives from its shareholders. In other words, it is a rate of return that measures the rate of return on capital provided by the company’s shareholders.

See the latest analysis from Retail Food Group

ROE calculation method

of Formula for Return on Equity teeth:

Return on Equity = Net Income (from Continuing Operations) ÷ Shareholders’ Equity

Therefore, based on the formula above, the Retail Food Group’s ROE would be:

2.6% = A$4.9 million ÷ A$184 million (based on the last 12 months to July 2022).

“Revenue” is the income a business earned in the last year. One way he conceptualizes this is that for every A$1 of share capital held by the company, the company made a profit of his A$0.03.

Why ROE Is Important to Profit Growth

It has already been established that ROE serves as an efficient profit-making metric to gauge a company’s future earnings. Based on the amount of profits the company chooses to reinvest or “retain”, the company’s ability to generate profits in the future can be assessed. Assuming all else remains the same, higher ROE and profit margins will necessarily lead to higher growth for a company compared to a company that does not have these characteristics.

Retail food group profit growth and 2.6% ROE

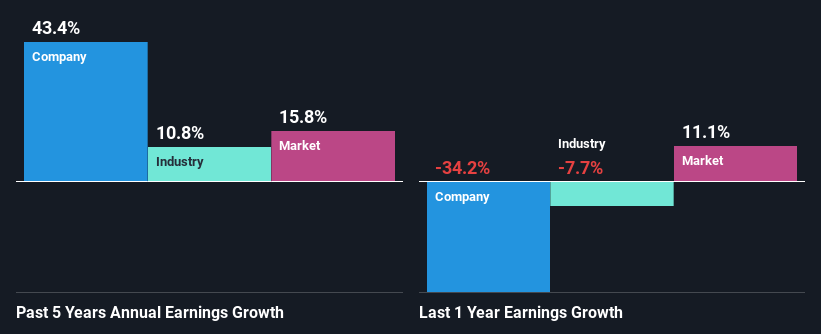

As you can see, Retail Food Group’s ROE looks pretty weak. The Company’s ROE is considerably lower than the industry average of 12%. But I’m pleasantly surprised that Retail Food Group has grown its net profit by a whopping 43% over the past five years. We believe there are other aspects that have a positive impact on the company’s revenue growth. For example, the company’s management may have made some excellent strategic decisions, or the company may have a low payout percentage.

Next, when compared to the industry’s net profit growth rate, we found that Retail Food Group had a very high growth rate compared to the industry average growth rate of 11% over the same period. This is great.

The foundation for adding value to a company is largely tied to revenue growth. It is important for investors to know whether the market is pricing in a company’s expected earnings growth (or decline). That way, you’ll know if your stock is headed for clear blue waters, or if wet waters await. Has the market priced in his RFG’s future outlook?You can find out in our latest intrinsic value infographic research report.

Is your retail food group making good use of its retained earnings?

Retail Food Group does not pay dividends to shareholders, so the company reinvests all profits back into the business. This may be driving the high revenue growth mentioned earlier.

Conclusion

Overall, Retail Food Group appears to have some positive aspects to its business. Despite the low rate of return, the company has recorded impressive revenue growth as a result of heavily reinvesting in the business. As such, the company is expected to see slower earnings growth in the future, according to the latest analyst forecasts study. To learn more about the company’s latest analyst forecast, check out this company’s analyst forecast visualization.

Do you have feedback on this article? What interests you? contact directly with us. Or send an email to our editorial team (at) Simplywallst.com.

This article by Simply Wall St is general in nature. We provide comments based on historical data and analyst projections using only unbiased methodologies and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis based on fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Is not …

Participate in Paid User Research Sessions

you $30 USD Amazon Gift Card An hour of your time while helping build better investment tools for individual investors like you.SIGN UP HERE