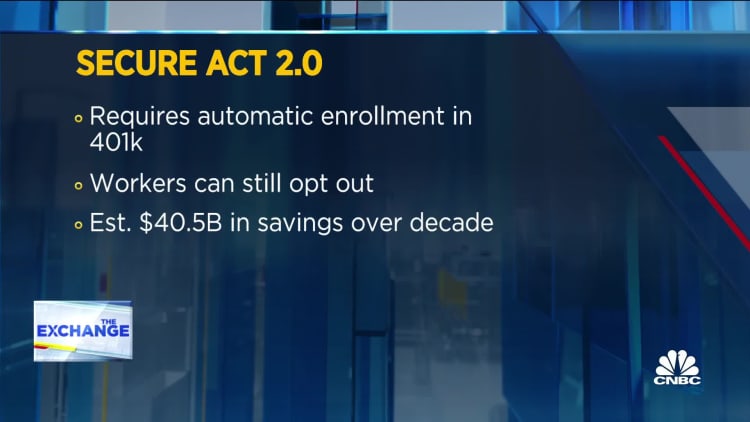

Under provisions contained in a legislative proposal known as “Secure 2.0” contained in the comprehensive appropriations bill that passed the Senate on Thursday and is awaiting a vote in the House, a “Savers Match” after retirement will be implemented, Existing methods are essentially changed. Tax deduction works.

Related investment news

If the bill is passed, people with incomes below set limits who contribute to eligible retirement accounts (i.e. 401(k) plans) will be limited to their own nest eggs, starting in 2027. You will receive federal “matching” contributions. Up to 50% of donations up to $2,000 to eligible accounts (i.e., matches up to $1,000 per person).

Matches are phased out (reduced) when married couples with incomes between $41,000 and $71,000 file joint tax returns. For a single taxpayer, the phase-out ranges from $20,500 to $35,500 and for a householder, her $30,750 to $53,250.

Current deductions may not always help taxpayers

A move to allow federal matching contributions is being called for because current tax credits are nonrefundable and you can’t get the deduction if you don’t owe federal income tax.

“The main drawback of today’s law is that it is non-refundable,” said Shai Aqabath, director of economic policy at the Bipartisan Policy Center.

Details from Personal Finance:

Pell Grant Could Rise Up To $7,395 Next Year

1 in 5 young adults are in debt, report finds

How health insurance helps keep inflation down

“As such, individuals who are not subject to federal income tax — the lowest and middle income earners — do not benefit from the deduction,” Akabas said. “This reform is an attempt to ensure that these people have the incentives and benefits to save money for the future.”

According to Kristen Carlisle, General Manager of Betterment at Work, the new Savers Match will help some workers who are not allowed to use the current tax credit, such as some government employees (such as school teachers) and gig workers. will also be available.

Carlisle said the match would be a “direct and substantive way to increase retirement savings and encourage good retirement planning habits for low- and middle-income workers.”

More than 108 million people qualify for Savers Match, according to the American Retirement Association.

Existing tax incentives continue to be available

In the meantime, existing tax credits will continue to be available and will remain in place until 2026 when Secure 2.0 provisions become law. But only 48% of workers recognize him, according to his 2021 report from the Transamerica Center for Retirement Studies.

The current tax credit is up to $1,000 (50% of the $2,000 contribution) for single tax filers with income up to $20,500 in 2022 and householders with income up to $30,750. For joint filers, if income is up to $41,000 for her, maximum credit is $2,000 for him (50% of her $4,000 in contributions).

If you exceed these income limits, credits are phased out — reduced from 50% to 20% or 10% — up to $34,000 (single), $68,000 (joint filers), and $51,000 It is reduced to the income of (head of household).